LIGA and Unpaid Claims: Accountability Concerns Mount for Homeowners in South Louisiana

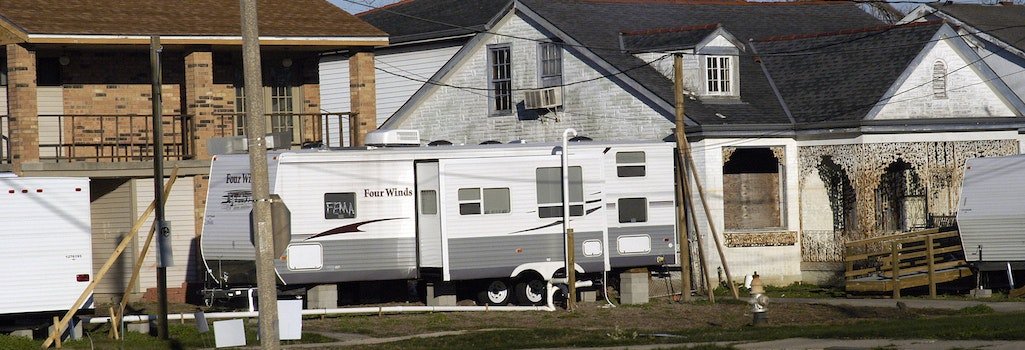

South Louisiana homeowners are increasingly seeking compensation from the Louisiana Insurance Guaranty Association (LIGA) after a series of financial difficulties led a dozen insurers to enter receivership over the past 18 months. With approximately 40,000 unsettled claims left in their wake, homeowners are eager for resolution and payment.

As the association responsible for overseeing an industry-backed fund, LIGA is obligated to cover claims of up to $500,000 per policy. However, frustrated homeowners argue that LIGA’s approach mirrors that of reluctant insurers, citing a cycle of different adjusters, unexplained delays, and denied claims.

Unlike traditional insurance companies, LIGA is protected from bad-faith damages, meaning they cannot be sued on those grounds. Consequently, plaintiffs’ attorneys involved in disputes leading to lawsuits are demanding a greater share of the settlement.

Already, more than 3,000 lawsuits related to insolvent insurers have been filed against LIGA, and this number is expected to rise significantly as the August 29 deadline for Hurricane Ida-related lawsuits approaches. To address the growing legal challenges, LIGA has engaged nearly two dozen law firms. These attorneys join the ranks of third-party entities such as adjusters, actuaries, and financial consultants, all working diligently to navigate through an unprecedented backlog of claims.

Lawyers representing the plaintiffs argue that these third-party entities also enjoy protection from bad faith claims and other damages while working for LIGA, leaving consumers with no recourse to address unethical conduct. With LIGA being immune from liability, they are not held responsible for attorney’s fees and court costs. Consequently, there is little incentive for LIGA to negotiate with policyholders, thus hindering the resolution process.

In the past, bad-faith penalties have acted as a deterrent for insurers engaging in deceptive business practices, including intentional underpayment of claims. Consumers dissatisfied with an insurer’s offer could invoke an independent appraisal process, a standard procedure in most policies. This process allowed both parties to select appraisers from a list maintained by the Louisiana Department of Insurance, and an umpire would then determine the final cost. Once an agreement was reached, the insurer typically committed to payment.

However, with LIGA, homeowners can still request an independent appraisal without hiring an attorney, but there is no guarantee that the association will accept it. Under Louisiana law, an attorney can seek additional damages against an insurer found to have significantly underpaid a claim. Regardless, LIGA is only obligated to pay the maximum amount specified in the claim and no more.